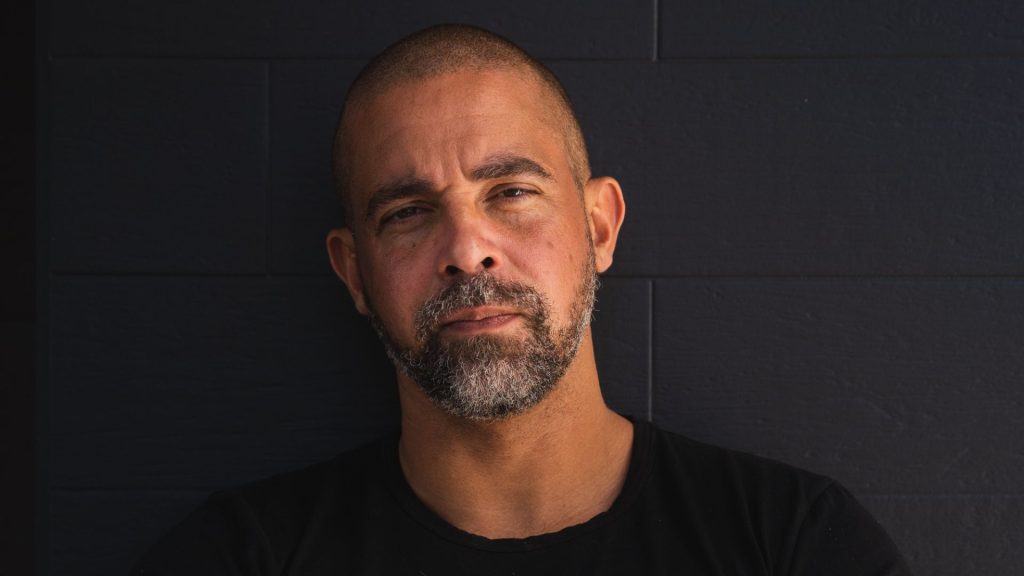

SMEs Are Being Robbed by Traditional Banks! AI Will Revolutionise Lending!- Chirag Shah

“Surround yourself with a team of people that share your vision and goals, and can effectively challenge you and contribute towards the final outcome…” – Chirag Shah

Today we feature Chirag Shah, the founder at Pulse. We hear their story in their own words, their successes, their business challenges and their insights.

As we sit down with the accomplished and dynamic founder of Pulse, it’s hard not to be intrigued by the story behind their success. With impressive achievements spanning across their background and career, this individual has undoubtedly made a significant impact in the world of business. Our conversation begins with getting to know the person behind the company, delving into their roots and the journey that led them to where they are today.

Let’s start with learning a bit about you.

My main motivation was after identifying significant challenges with the availability of SME data when I started Nucleus. Another inspiration was Uber; the simplicity of the concept, its ease of use and the part it plays in everyday life. I wanted to provide tools and funding to enable SMEs to be run more efficiently.

Before starting Nucleus, I was a portfolio manager at Acheron Capital, a London-based asset manager which focuses on life insurance acquisitions. I was responsible for sourcing, due diligence, monitoring and liquidation of distressed assets in asset-based lending deals, hedge funds, and life settlements.

As we transition to discussing their brainchild, Pulse, we’re eager to discover what sets this company apart and how it contributes to the global marketplace. With a growing presence and an ambitious vision, we delve into the core of the company and its origins.

What does Pulse do and where is your company based?

We currently serve small and medium-sized enterprises across the UK market. With Pulse, we have developed a market-leading technology that enables SMEs to achieve one-click lending, meaning that more than 90% of lending decisions are now made within seconds. This is achieved by using open banking and open accounting to improve access to lending for SMEs. We decided to further build out those tools to provide ongoing support to SMEs using data-driven insights to allow for better-informed decisions by business owners. Our objective was to make running an SME simple. That is accomplished by providing one snapshot of the business to highlight the key areas that they need to focus on moving forward. The company is based in central London.

As we continue our conversation, we delve deeper into the driving forces and defining moments that have shaped your journey. So what has been the story behind your success?

When I started Nucleus back in 2011, I wanted to make us a competitive alternative to banks in the UK SME market. I wanted to provide a multi-product offering which was similar to what the banks already did but had a quicker application process, making it easier for SMEs to access.

Since then, and over the last seven years in particular, we have focused on becoming a true partner for SMEs, helping them to use their data more effectively to make more timely decisions and providing our clients with clear visibility in terms of liquidity and our available loan offerings. Today, we are a leading fintech company in the UK, with market-leading technology capabilities.

Thank you for sharing that Chirag. So what are the biggest challenges involved in the availability of business finance and lending? How are you helping borrowers deal with them?

There is a distinct mismatch between SMEs’ expectations and what lenders can offer. As a result, we are seeing lower approval rates, lower amounts offered, higher rates and more security requested by lenders across the market. This has created a dysfunctional market.

Despite this, we are seeing signs of improvement and expect that lending conditions will get better in the second quarter. This will be driven by artificial intelligence and machine learning, which has enabled lenders to shorten the loan application time, provide instant decisions, and enable better decision-making on credit and greater access to finance for SMEs with shorter trading histories.

We have focused on becoming a true partner for SMEs, helping them to leverage their data in order to make more timely decisions and providing our clients with clear visibility in terms of liquidity and our available loan offerings.

Once you start, you need to create a user experience that is intuitive, collaborative and simple.

Being a thought leader, what is your opinion on business lending and borrowing in 2023 so far, especially given the integration with artificial intelligence and machine learning?

2023 has been a challenging year, without a doubt. Given the current economic situation, there are increasingly more SMEs looking for funding, either to keep their business going, meet their financial obligation or invest for growth. At the same time, many lenders are being extremely cautious about who they offer loans to and the amounts they offer given viable concerns about borrowers defaulting. But I’m optimistic that things will get better, and soon.

A key enabler and driving force behind this resurgence will be artificial intelligence. As the technology becomes more widely integrated across the lending sector, the outcomes will improve for all. It will be a win-win situation all around. Lenders will be able to make quicker and more accurate loan approval decisions, while SMEs will get immediate access to the essential funding they require when they need it most.

You emphasize the importance of artificial intelligence being a key enabler. With that in mind, I’m curious about the practical side of running Pulse. What three technology tools help Pulse run better?

Apps and tools are useful, but only if there is a will to succeed. For us, that means striving to achieve business growth and efficiency in everything we do; being willing to share data; and being open to making any key decisions and changes based on data-driven recommendations.

Having extensive experience of more than a decade, we would like to know how the finance industry has disrupted traditional financing to a new generation of financial innovation.

SMEs’ finance needs have evolved. In a world of Amazon and Uber, business owners expect nothing less than clear communication, instant decisions and outstanding user experience. Yet, traditional providers are still struggling to meet these ever-growing demands. That’s where fintechs have stepped in to fill the gap and are constantly raising the bar concerning what they can offer the customer.

What has been your greatest or proudest achievement or moment?

I’d have to say the first deal we ever did. Back then, we were one of the first alternative providers, at a time when the market was dominated by banks. The first deal was an invoice finance facility and sent a clear message to the market that we can deliver. Another thing that I’m proud of is the multiple deals where we have used a combination of different products to support a client.

Our position in the market is very much oriented around our offering of multiple products and the fact that we can use them to tailor a solution to exactly the client’s requirements – and that is something fairly unique. The high street lenders have traditionally offered multiple products but struggle with the internal communication necessary to create truly bespoke combined solutions and of course, they lack the agility that alternative funders, such as Nucleus have.

It truly differentiates us and positions us in the middle – with the technology and innovation of a fintech provider but with the product range and expertise of a traditional lender. Of course, one of the milestones we’ve recently achieved is £2.8 billion funded to businesses, across all products. It is a great team effort to get to this point and is a reflection of the hard work that our entire team has put in over the past seven years. I’m incredibly proud of how far we have come, as a team and a business.

Hearing about the remarkable growth and transformation of Pulse is truly inspiring. Your dedication to providing the best products and services to your customers has paid off.

As we look towards the future, I’m curious to know what future goals you want to achieve for your business.

To provide cutting-edge business insights using our technology. This will include a real-time snapshot of the business to all decision-makers; the ability to drill down into granular detail and make more informed decisions; and one-click lending, so SMEs always know how much they can borrow and can access funds within a matter of seconds. Ultimately, we want to make Pulse the go-to lending platform for SMEs.

As we wrap up our conversation, if there was one piece of advice you would give to another founder or someone thinking about starting, what would it be and why?

First, you need to surround yourself with a team of people who share your vision and goals and can effectively challenge you and contribute towards the outcome. Then you need to carry out a proof of concept to make sure that your idea will work. Once you start, you need to create a user experience that is intuitive, collaborative and simple. If users decide not to use your product, it doesn’t matter how good the quality is. You also need to work out your unit economics at the start of the product life cycle to ensure that it is viable, as well as focus on key routes to market and driving efficiency.

“Thank you, Chirag. It has been great learning more about your founder story and Pulse.”

To learn more about Pulse Visit: https://mypulse.io

Inspired by this story? Please share this story and other founder stories.

Disclaimer:

The views, thoughts, information, and opinions expressed in the text, videos, images belong solely to those of the individuals involved, and do not necessarily represent those of Founderat.com and its corporate owners, employees, organization, committee, or other group or individuals.